FEMA can help support your recovery from a major disaster.

For medical assistance: Call 9-1-1

Getting Started

FEMA Reforms Disaster Assistance Program

On March 22, 2024, FEMA implemented significant updates to disaster assistance. Read about the updates.

Get tips on steps to take before applying for disaster assistance, such as taking photos and making a list of damages and filing a claim with your insurance company.

Discover steps to take after applying for disaster assistance such as reviewing your application, verifying your identity and homeownership, getting a home inspection and submitting documentation.

Learn about required documentation, ways to submit an appeal and what to do after submitting an appeal if you disagree with FEMA’s decision.

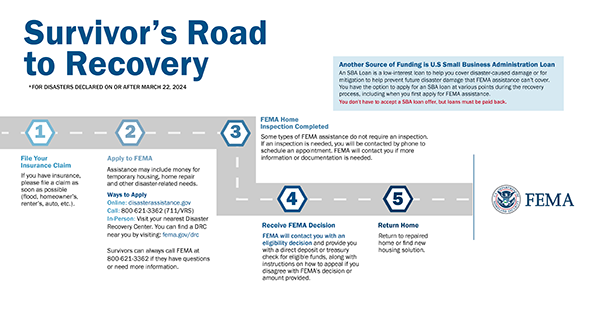

Road to Recovery

While not all disaster survivors' path to recovery is the same, this interactive tool steps you through the typical processes and requirements to follow that can help get you the support you need after experiencing a disaster.

Get Started on the Road to Recovery

Understanding Types of Assistance

Explore the Individuals and Households Program (IHP) that provides financial assistance and direct services to eligible individuals and households affected by a disaster, who have uninsured or underinsured expenses and serious needs.

Learn about several other programs designed to support disaster survivors offered by FEMA including mass care, crisis counseling, case management, legal services, and unemployment assistance.

Additional Resources

Get information about policies, guidance, and fact sheets of FEMA’s Individual Assistance programs, including the FEMA Individual Assistance Program and Policy Guide (IAPPG).

Read about major changes to our Individual Assistance (IA) programs to address historic challenges faced by disaster survivors.