Applying for Safeguarding Tomorrow RLF Funds

Program Overview

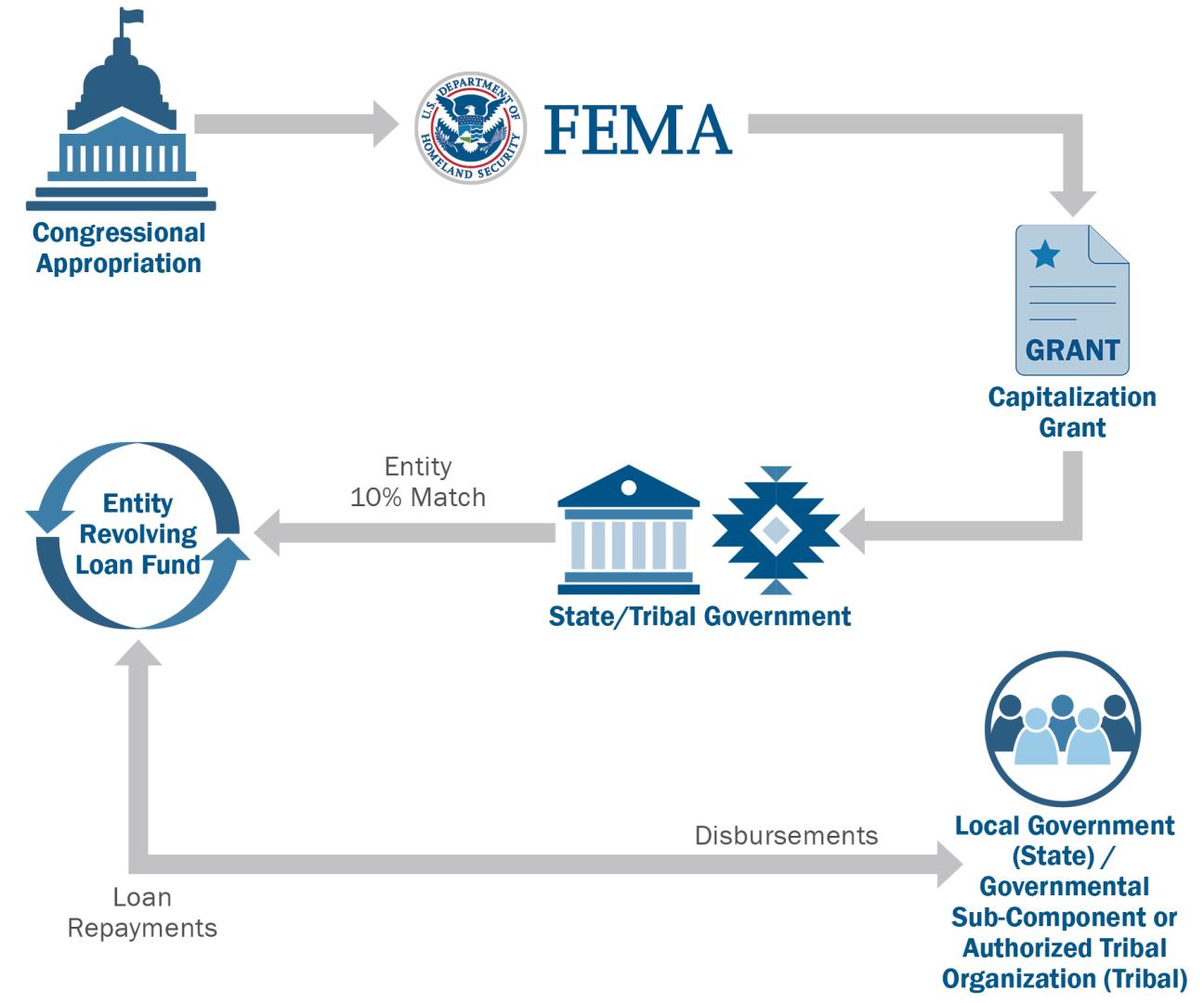

The Safeguarding Tomorrow Revolving Loan Fund (RLF) program is authorized under Section 205 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act to provide capitalization grants to states, eligible federally recognized tribes, territories and the District of Columbia to establish revolving loan funds that provide hazard mitigation assistance for local governments to reduce risks from natural hazards and disasters.

The Safeguarding Tomorrow RLF program complements and supplements FEMA’s Hazard Mitigation Assistance grant portfolio to support mitigation projects at the local government level and increase the nation’s resilience to natural hazards.

These low interest loans will allow jurisdictions to reduce vulnerability to natural disasters, foster greater community resilience and reduce disaster suffering.

Fiscal Year 2024 Selections

On Sept. 16, 2024, FEMA announced selections for the $150 million made available in the second year of the new Safeguarding Tomorrow Revolving Loan Fund (RLF) program.

The program's capitalization grants provide low-interest loans to local governments most in need of financial assistance, including low-income geographic areas and underserved communities.

Learn More About the Selections

Review the Safeguarding Tomorrow RLF selections for fiscal year 2023.

Applying for Safeguarding Tomorrow RLF Funds

Materials and information are available to help entities that are interested in applying for Safeguarding Tomorrow RLF funds to create a revolving loan fund.

Learn more about what happens during the application process.

Learn more about the reporting and auditing processes for entities that establish revolving loan funds.

Program Overview

Eligibility

The Safeguarding Tomorrow through Ongoing Risk Mitigation Act (STORM Act ) allows FEMA to award capitalization grants for eligible entities to make funding decisions and award loans directly to local communities.

Eligible entities are:

- States

- Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, and the District of Columbia

- Federally recognized tribes that received a direct major disaster declaration are eligible to apply for funding as an entity in this new program. Tribal entities may provide a loan to any authorized tribal organization, including a sub-component within their respective governmental structures. Additionally, Indian tribes located within a participating entity (such as a state or territory) may also apply for a loan under a participating entity’s revolving loan fund.

Program Highlights

The Infrastructure Investment and Jobs Act (IIJA) became law on Nov. 15, 2021, fully funding the Safeguarding Tomorrow Revolving Loan Fund program and appropriating $500 million over five years. This will last through fiscal year 2026.The program complements FEMA’s Hazard Mitigation Assistance grant portfolio to support mitigation projects at the local government level and increase the nation’s resilience to natural hazards.

In the inaugural year of the Safeguarding Tomorrow Revolving Loan Fund program, FEMA gave qualified applicants the opportunity to apply for up to $50 million in capitalization grants to create a revolving loan fund. Revolving loan funds are intended to reach local governments most in need of financial assistance, including low-income geographic areas and underserved communities.

FEMA will bridge the lessons learned throughout the first application cycle to make enhancements to the program and increase access. We anticipate releasing the next funding opportunity later this fall with higher amounts to encourage participation.

Differences with the Safeguarding Tomorrow RLF Program

In other Hazard Mitigation Assistance grant programs, states and federally recognized tribes are pass-through entities which route subapplicant requests to FEMA for review.

Through the Safeguarding Tomorrow RLF program, FEMA empowers entities to make funding decisions and award loans directly. The revolving loan funds that they create will help local governments carry out hazard mitigation projects that reduce disaster risks for homeowners, businesses, nonprofit organizations and communities to help them build resilience.

- FEMA will not limit or restrict project types beyond the limitations in statute.

- Loans may be used as a non-federal cost match for another HMA grant application.

- FEMA will not require entities to submit a benefit-cost analysis.

Program Priorities

The priorities of the Safeguarding Tomorrow RLF program are to:

- Empower Entities. FEMA will collaborate with eligible entities to help them increase their capacity and capability, through focused engagement activities leading up to the application period and providing increased technical assistance during the Year 1 application period.

- Create innovative funding solutions. Applicants can leverage loans for non-federal cost share with other FEMA Hazard Mitigation Assistance programs, helping underserved communities access additional funding resources.

- Deliver equitable investments and increased access. A goal of the Safeguarding Tomorrow RLF program is that 40% of the overall benefits generated by the entity loan funds flow to underserved communities.

- Reduce grant application complexity. The goal of launching this effort is to reduce program complexity by breaking down barriers and increasing access to mitigation funding.

- Maximize administrative flexibility. Throughout the process, identify administrative burdens and reduce them to the greatest extent possible.

Read a fact sheet on the Safeguarding Tomorrow RLF program.