Available Funding

Eligible Projects and Project Types

FY24 Changes

Application Process Overview

Additional Details

The Flood Mitigation Assistance Swift Current (Swift Current) effort provides funding to mitigate buildings insured through the National Flood Insurance Program (NFIP) after a major disaster declaration following a flood-related disaster event to reduce risk against future flood damage.

The full funding opportunity announcement is available on Grants.gov.

Available Funding

Funds will be made available to states, territories, and federally recognized tribal governments that receive a major disaster declaration following a flood-related disaster event and meet all other eligibility criteria. Swift Current funding is only available to property owners that have a current flood insurance policy under the National Flood Insurance Program (NFIP) and a history of repetitive or substantial damage from flooding.

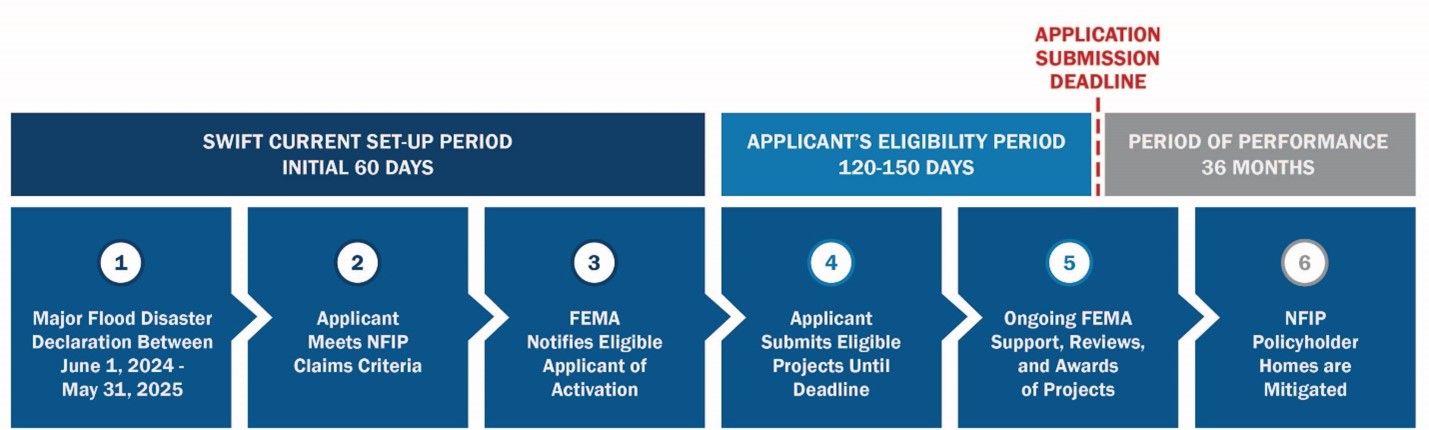

The total funding available for fiscal year 2024 is $300 million, which was made possible through the Infrastructure Investment and Jobs Act (IIJA), better known as Bipartisan Infrastructure Law (BIL). The figure below provides an overview of the key steps in the Swift Current process.

Join us for a webinar to learn more about the Swift Current Fiscal Year 2024 Notice of Funding (NOFO) on June 18, 2024, from 2-3:30 p.m. ET.

Eligible Projects and Project Types

Swift Current funds Individual Flood Mitigation Projects for Flood Mitigation Assistance and/or NFIP-defined Repetitive Loss (RL), Severe Repetitive Loss (SRL), or properties deemed Substantially Damaged after the applicant’s disaster declaration incident period start date.

Eligible Individual Flood Mitigation Projects include the following project types which may be referenced in the Hazard Mitigation Assistance Program and Policy Guide:

- Property acquisition and structure demolition/relocation

- Structure elevations

- Dry floodproofing of historic residential structures or non-residential structures

- Non-structural retrofitting of existing structures and facilities

- Mitigation reconstruction

- Structural retrofitting of existing structures

For fiscal year 2024, Swift Current now offers Project Scoping as an eligible activity for applicants. Applicants may submit Project Scoping applications up to 1% of the total maximum set-aside, and tribes and territories applying as applicants may submit up to 5%. Project Scoping is considered a part of the maximum set-aside amount.

Fiscal Year 2024 Changes

The fiscal year 2024 Swift Current funding opportunity builds on the prior year funding notice.

- Swift Current applicants now use FEMA Grants Outcomes (FEMA GO) as the system of record—submissions no longer go through Mitigation (MT) eGrants.

- The eligibility period start date for applicants changed from 30 days to 60 days after the applicant meets activation eligibility criteria.

- Applicants may now be eligible for future activations, up to $10 million, if they experience another qualifying event.

- Project Scoping is now an eligible activity. States and the District of Columbia may submit subapplications for up to 1% of the total maximum set-aside, and tribes and territories may submit for up to 5%.

- Project Scoping is considered part of the maximum set-aside amount.

Application Process Overview

The local government is considered the subapplicant and will develop a subapplication with any interested property owners. The local government will then submit the subapplication to appropriate state, tribal or territorial government on the property owner’s behalf. Tribal governments applying as applicants will work directly with FEMA to submit their application.

Tailored Pre-Application Support

FEMA is offering tailored pre-application support to applicants and subapplicants applying for this funding opportunity. Support may include: subapplication development, FEMA GO system support, Benefit-Cost Analysis support, project cost estimates, and Environmental and Historic Preservation assistance.

For more information about this tailored pre-application support, contact the State Hazard Mitigation Officer, FEMA Regional Office, or Regional Tribal Liaison.

How to Apply

Key Dates

- The application window opens June 1, 2024.

- Disaster Declaration Deadline: May 31, 2025; FEMA will accept applications upon activation for major disaster declarations of flood-related events that occur between June 1, 2024 - May 31, 2025. The application submission deadline will vary depending on the activation criteria met and disaster declaration date.

- The eligibility period refers to the time that the applicant may submit subapplications to Swift Current. The eligibility period start date will vary by applicant.

- Upon Swift Current activation, FEMA will provide the application deadline to the applicant. All applications must be received by the given deadline. Subapplicants should consult with their applicant agency to confirm subapplication deadlines.

- Local governments should consult with their state, tribal or territorial agency to confirm deadlines to submit subapplications for their consideration.

- All eligible applicants must submit their FY 2024 Swift Current applications to FEMA via FEMA Grants Outcomes (FEMA GO).

- FEMA will distribute funding on a rolling basis as eligible applicants submit applications, until the total available funding amount of $300 million is exhausted.

Submit Using the FEMA Grants Outcomes (GO) System

All eligible applicants must submit their FY 2024 Swift Current grant applications to FEMA using the FEMA GO System.

If you need help with FEMA GO, reach out to:

- FEMA GO Help Desk

- Programmatic Helpline at 877-585-3242 for Hazard Mitigation Assistance programmatic support for questions

FEMA will distribute funding on a rolling basis as eligible applicants submit applications until the total available funding amount of $300 million is exhausted.

Additional Details

The National Flood Insurance Program helps reduce the impacts of flooding through risk mapping, mitigation, and administering flood insurance. Through careful data sharing with communities the NFIP enables local community planners, officials, and administrators to: develop hazard mitigation plans and updates; effectively manage their floodplains; submit grant applications; and more. FEMA provides publicly available data online. For sensitive data, there is an established protocol that dictates who is allowed to receive it.

Receiving sensitive data requires that a legal data sharing agreement be drafted to ensure proper and secure processing and handling of the data. The aim is a 10-day turnaround time from FEMA’s receipt of the data request to the delivery of data.

There are two types of data sharing agreements: Routine Use Letters (RULs) and Information Sharing Access Agreements (ISAAs).

- ISAAs last for three years and can be used for multiple ongoing data requests.

- RULs are for a one-time request only. A completed data request form may be sent to a FEMA Regional Flood Insurance Liaison or Specialist.

General questions about Swift Current can be directed to your State Hazard Mitigation Officer or FEMA regional office.