FEMA Media Library

Public Notice for Long-Term Sustainability for Provo’s Water Supply, EMD-2021-BR-063-0001, September 2023

Faith-Based Learning Resource Menu, FEMA Education, Training, Exercise, and Support for Faith-based Organizations and Community Leaders

FEMA provides Planning Guides to support community engagement in emergency preparedness. These guides help the whole community think through the lifecycle of a potential crisis, determine required capabilities, and establish a framework for roles and responsibilities.

Final Programmatic Environmental Assessment and Finding of No Significant Impact (FONSI) signed 9/10/2025 for Improvement of Utility Systems in the State of Colorado, September 2025

Final Environmental Assessment including FONSI signed 4/3/2025 for Jefferson County Drainage District No. 7 Groves Detention Project, HMGP-4332-0168-TX (1), April 2025

PDA Narrative Report Survey Template v1.0.0

Finding of No Significant Impact (FONSI) for the Enrique Ortega Water Treatment Plant Raw Water Intake Power Generators, HMGP-4339-0019-PR, signed 9/9/2025

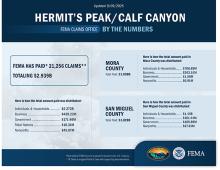

Hermit's Peak/Calf Canyon by the Numbers 09/09/25

Draft Tiered Site-Specific Environmental Assessment for Emergency Operations Center, 2024-EO-05003 (50328), June 2025

Fundamentals of Grants Management Course Schedule (Fiscal Year 2026)

2025 Public Meeting Presentation for the National Flood Insurance Program (NFIP) – Endangered Species Act (ESA) Integration in Oregon, September 2025