This fact sheet provides an overview of the intent and objectives for the Safeguarding Tomorrow through Ongoing Risk Mitigation Revolving Loan Fund (Safeguarding Tomorrow RLF) program. Additional information and requirements can be found in the program’s Notice of Funding Opportunity.

Program Intent

Objectives

FEMA’s Safeguarding Tomorrow RLF program is the first Hazard Mitigation Assistance program to provide capitalization grants to eligible entities for revolving loan funds. Eligible entities are defined by Section 205(m)(3) of the Robert T. Stafford Disaster Relief and Emergency Assistance Act and include:

- any state of the United States;

- the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa and the Commonwealth of the Northern Mariana Islands; and

- federally recognized Tribal Nations having received a major disaster declaration under the Robert T. Stafford Disaster Relief and Emergency Assistance Act.

The program’s intent is to provide an opportunity for these entities to make low-interest loans to local governments most in need of financial assistance, including low-income geographic areas and underserved communities. FEMA will not be selecting projects or awarding loans.

A revolving loan fund is a funding mechanism that allows entities to issue loans to local governments to finance a project or activity. After the project or activity is completed, the loans are repaid to the revolving loan fund with applicable interest. Funding associated with the revolving loan fund is continuously recycled, which allows entities to issue additional low-interest loans for the life of the revolving loan fund. A revolving loan fund established by an eligible entity under the Safeguarding Tomorrow RLF program is also referred to as an “entity loan fund.”

Working with eligible entities, FEMA will gather best practices on topics such as entity administrative burden and capacity, achieving resilience and equity goals, and common project and activity types for loans under this program.

Statutory priorities for projects funded under the program include:

- Projects that increase resilience and reduce the risk of harm to natural and built infrastructure.

- Projects that involve a partnership between two or more eligible entities.

- Projects that take into account regional impacts of hazards.

- Projects that increase the resilience of major economic sectors or critical national infrastructure.

FEMA’s priorities for the Safeguarding Tomorrow RLF program are to:

- Empower Entities. FEMA will collaborate with eligible entities to help them increase their capacity and capability, through focused engagement activities and providing increased technical assistance during the Year 1 application period.

- Create innovative funding solutions: Applicants can leverage loans for non-federal cost share with other FEMA Hazard Mitigation Assistance programs, helping low-income geographic areas and underserved communities access additional funding resources.

- Deliver equitable investments and increased access: A goal of the Safeguarding Tomorrow RLF program is that at least 40% of the overall benefits generated by the entity loan funds flow to underserved communities.

- Reduce grant application complexity: The goal of launching this effort is to reduce program complexity by breaking down barriers and increasing access to mitigation funding.

- Maximize administrative flexibility: Throughout the process, FEMA will identify administrative burdens and reduce them to the greatest extent possible.

Entity-Led Approach

Through the Safeguarding Tomorrow RLF program, FEMA empowers entities to make funding decisions and award loans directly. An entity will use awarded capitalization grant funding to administer its revolving loan fund and provide direct loans to local governments based on its unique mitigation needs and priorities. Eligible uses for funds under this program include:

- Projects or activities that mitigate the impacts of natural hazards

- Mitigation planning

- Building code adoption and enforcement

- Zoning and land use planning changes

- Technical assistance to recipients of financial assistance from the entity loan fund

- Entity loan fund administration costs

- The non-federal cost share requirement for other FEMA Hazard Mitigation Assistance grants

Program Implementation

Grant Application Process

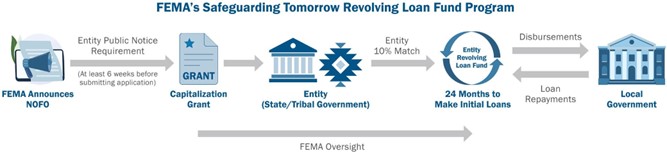

To apply for grant funding, eligible entities must adhere to the application and funding deadlines as provided in the Notice of Funding Opportunity. All applications and supporting materials must be submitted using FEMA’s Non-Disaster (ND) Grants management system. Prior to applying, an eligible entity must fulfill several federal statutory requirements, including:

- Having a FEMA-approved State or Tribal Hazard Mitigation Plan;

- Issuing a public notice soliciting proposals from local governments for hazard mitigation projects and activities no less than six weeks prior to the submission of a grant application;

- Developing an application including a standard Application for Federal Assistance (SF-424), program-specific Capitalization Grant Application form, Intended Use Plan, and Project Proposal List;

- Posting the entity-developed Intended Use Plan for public comment prior to submitting a grant application;

- Establishing a revolving loan fund for which the eligible entity’s emergency management agency has authority to manage the Safeguarding Tomorrow RLF program; and

- Determining how the entity cost match (at least 10% contribution) will be met.

These items are further explained in program support materials available on the Safeguarding Tomorrow RLF program webpage. Additional tribal-specific information for the current funding cycle can be found in this webinar. During the application period, FEMA will provide technical assistance to support eligible entities throughout the grant application process.

FEMA will review submitted grant application materials for completeness and compliance with federal statutory requirements before awarding capitalization grants. More information about entity eligibility and program requirements is available on the Safeguarding Tomorrow RLF program webpage.

The grant application process is summarized below.

Entity Loan Fund Process

Eligible entities must establish a revolving loan fund to be administered by their respective emergency management agency for FEMA to provide funding in the form of a capitalization grant. The eligible entity must deposit an amount that is at least 10% of the capitalization grant into an established entity loan fund. The process from loan awards to revolving funds will be as follows:

- The entity loan fund provides assistance through low-interest loans to local governments to expedite eligible mitigation activities in their communities with greater flexibility and autonomy.

- The eligible entity is responsible for monitoring project progress and loan repayment from local communities.

- As local governments repay loans, these funds can be utilized for new loans.

- FEMA will monitor the use of funding through reporting mechanisms and audits.

This process is summarized below.

Program Capitalization Grant Versus Entity Loan

FEMA will award capitalization grants to be used by the eligible entity to administer the revolving loan fund, award loans to local governments, and provide technical assistance to loan recipients.

Loans will be available from entities who receive capitalization grants to help local governments fund mitigation projects, as well as to satisfy non-federal cost share requirements under FEMA Hazard Mitigation Assistance programs, update building codes adoption and enforcement, and make zoning and land use changes.

Capitalization Grant

- Administered by FEMA according to federal statutory requirements and best practices

- Grant agreement between FEMA and an eligible entity (such as a State or eligible Tribal Nation)

- The entity will not repay FEMA for grant funds received, but must comply with federal oversight of grant management requirements

Entity Loan Fund

- Administered by the eligible entity according to the grant agreement and its FEMA-approved Intended Use Plan

- Loan agreements between the entity and loan recipient (such as local governments) with a maximum interest rate of 1%

- Loan recipient must pay back the funds in accordance with the eligible entity’s requirements

Additional Program Information

The Safeguarding Tomorrow RLF program webpage will be the primary resource for program updates and information. This is an evolving new program and FEMA will regularly update program resources and materials as needed. Comments and questions may also be submitted by email to FEMA-STORMRLF@fema.dhs.gov.