As of April 1, 2023, FEMA has fully implemented the National Flood Insurance Program's (NFIP) pricing approach, Risk Rating 2.0. The approach leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarially sound, easier to understand and better reflect a property’s flood risk.

Many of these documents were updated pursuant to Executive Orders in April 2025.

NFIP policyholders can contact their insurance company or insurance agent to learn more about what NFIP’s pricing approach means to them.

The rating approach was implemented in phases from Oct. 1, 2021 through April 1, 2023.

FEMA continues to engage with Congress, its industry partners and state, local, tribal and territorial agencies to ensure a clear understanding of these changes that took place on the rating methodology and how it impacted policyholders.

Phase I

As of Oct. 1, 2021, new policies were subject to NFIP’s pricing approach.

Phase II

All remaining policies renewing on or after April 1, 2022, were subject to the new pricing approach.

Phase III

As of April 1, 2023, FEMA fully implemented new pricing approach.

Video: Defining a Property's Unique Flood Risk

Why FEMA Undertook NFIP’s Pricing Approach

FEMA is committed to building a culture of preparedness across the nation. Purchasing flood insurance is the first line of defense against flood damage and a step toward a quicker recovery following a flood.

Since the 1970s, rates have been predominantly based on relatively static measurements, emphasizing a property’s elevation within a zone on a Flood Insurance Rate Map (FIRM).

The 1970s legacy methodology did not incorporate as many flooding variables as NFIP’s pricing approach. FEMA is building on years of investment in flood hazard information by incorporating private sector data sets, catastrophe models, and evolving actuarial science. In addition, the 1970s legacy rating methodology did not account for the cost of rebuilding a home. Policyholders with lower-valued homes may have been paying more than their share of the risk while policyholders with higher-valued homes may have been paying less than their share of the risk. NFIP’s pricing approach enables FEMA to set rates that are fairer and ensures up-to-date actuarial principles based upon new technology, including modeling.

With NFIP’s pricing approach, FEMA is using new capabilities and tools to address rating disparities by incorporating more flood risk variables. These include flood frequency, multiple flood types—river overflow, storm surge, coastal erosion and heavy rainfall—and distance to a water source along with property characteristics such as elevation and the cost to rebuild.

With the implementation of NFIP’s pricing approach, FEMA is now able to distribute premiums across all policyholders based on home value and a property’s flood risk, and set rates that are fairer.

What Didn’t Change Under NFIP’s Pricing Approach

We are upholding statutory requirements by:

Limiting Annual Premium Increases

Existing statutory limits on rate increases require that most rates not increase more than 18% per year.

Using Flood Insurance Rate Maps (FIRMs) for Mandatory Purchase and Floodplain Management

FEMA’s flood map data informs the catastrophe models used in the development of rates under NFIP’s pricing approach. That is why critical flood mapping data is necessary and essential for communities. It informs floodplain management building requirements and the mandatory purchase requirement.

Maintaining Features

We maintained features to simplify the transition to NFIP’s pricing approach by offering premium discounts to eligible policyholders. This means:

- FEMA is continuing to offer premium discounts for pre-FIRM subsidized and newly mapped properties.

- Policyholders are able to transfer their discount to a new owner by assigning their flood insurance policy when their property changes ownership.

- And discounts to policyholders in communities who participate in the Community Rating System will continue. Communities can continue earning National Flood Insurance Program rate discounts of 5% - 45% based on the Community Rating System classification. However, since the NFIP’s pricing approach does not use flood zones to determine flood risk, the discount will be uniformly applied to all policies throughout the participating community, regardless of whether the structure is inside or outside of the Special Flood Hazard Area.

Documents and Resources

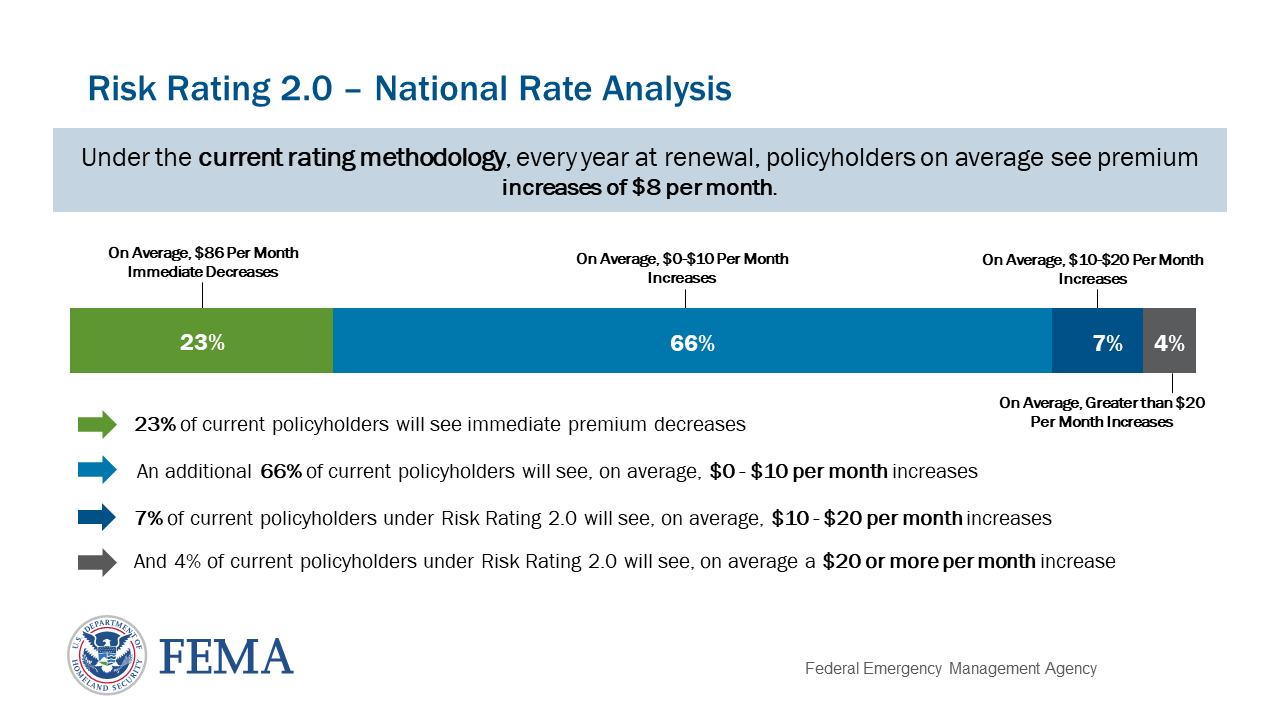

Infographic: National Rate Analysis

Analysis is based on the transition of existing policies which occurred from Oct. 1, 2021 - March 31, 2023.

Release Date: April 2021

State Profiles

View the collection of 50 state profiles, which describe Risk Rating 2.0 changes specific to each state based on the transition of existing policies which occurred from Oct. 1, 2021 – March 31, 2023.

View State Profiles

Exhibits: Single-Family Home

Browse exhibits of what flood insurance costs for a single-family home under Risk Rating 2.0.

View Pricing Data

Technical Documents

- Risk Rating 2.0 Methodology and Data Sources

- Risk Rating 2.0 Methodology and Data Sources - Premium Calculation Worksheet Examples

- Risk Rating 2.0 Methodology and Data Sources - Appendix D Rating Factors

- Levees in Risk Rating 2.0

- Discount Explanation Guide

- Rate Explanation Guide

Learn More about NFIP’s Pricing Approach

Customers

To learn more about the value of flood insurance, please speak with your agent, insurance provider or visit Flood Smart.

Agents

Learn more about Risk Rating 2.0. Information includes answers to frequently asked questions and shareable marketing resources to help your clients understand their property’s unique flood risk.

Contact Us

Have questions? Please send us an email.