Did You Know?

Prepare Financially

Infographics

Resources

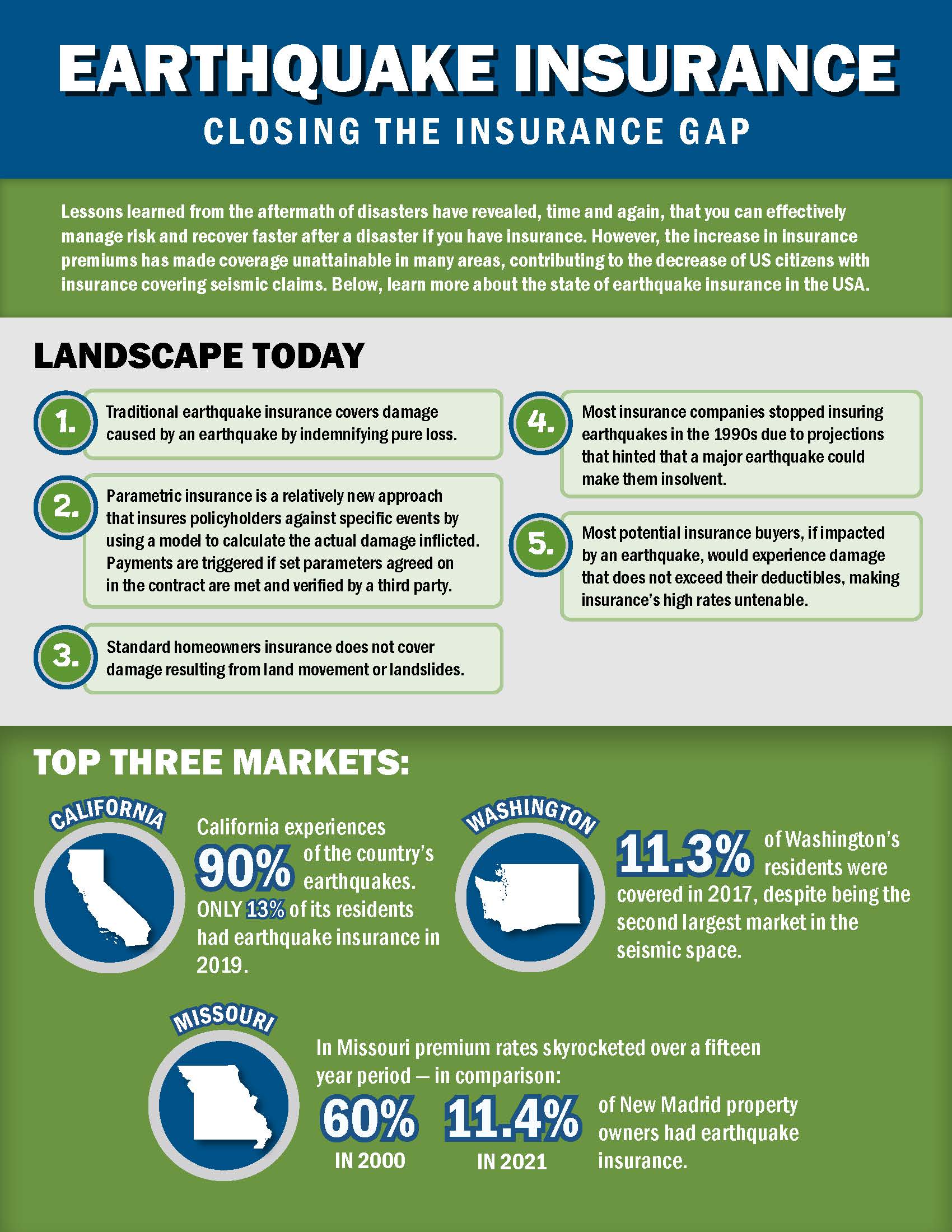

Lessons learned from the aftermath of disasters have revealed, time and again, that you can effectively manage risk and recover faster after a disaster if you have insurance. However, the increase in insurance premiums has made coverage hard to get in many areas, contributing to the decrease of insurance covering seismic claims.

Did You Know?

Standard homeowners’ insurance does not cover damage resulting from land movement or landslides.

Many insurance companies stopped insuring earthquakes in the 1990s after projections suggested that a major earthquake could potentially bankrupt them.

If impacted by an earthquake, most homes would experience damage that does not exceed their insurance deductibles, meaning that even with insurance’s high rates, insured homeowners would not receive money from their policy to address the damage.

The U.S. is Underprepared for Earthquakes

The top three markets in the country — California, Washington and Missouri — highlight how unprepared the nation is.

- Despite experiencing 90% of the country’s earthquakes, only 10% of California’s residents have earthquake insurance.

- Only 11.3% of Washington’s residents were covered in 2017 despite having the second-largest market in the seismic space.

- Missouri’s New Madrid area is a lesson in what skyrocketing premiums can do to the insurance market. In 2000, 60% of its residents had coverage. As of 2021, that number has declined to 11.4%.

How to Financially Prepare for an Earthquake

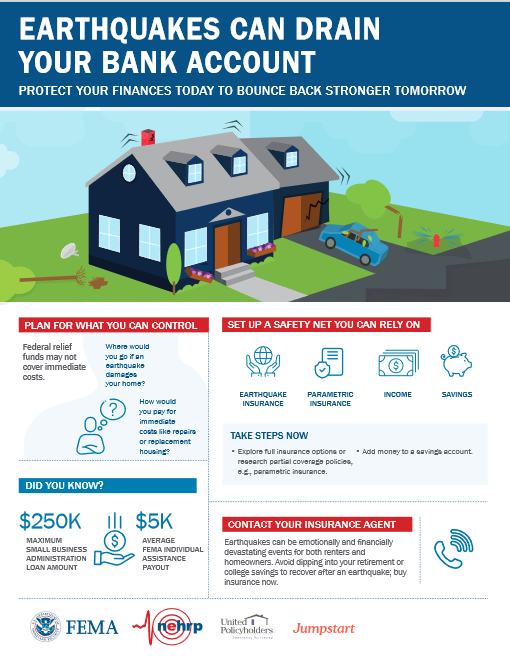

While earthquakes cannot be predicted, what you do financially can be. Take proactive steps today by setting up a safety net you can rely on!

Insurance

Traditional earthquake insurance covers damage caused by an earthquake by insuring “pure loss.” That means they will assess the value of the items lost and reimburse you for that specific amount – this amount will be different for different people.

Parametric insurance is a relatively new approach that insures policyholders against specific events by using parameters (set criteria that applies to everyone) to determine the cost of the damage.

Payments are triggered if set parameters agreed on in the contract are met (for example, when an earthquake meets or exceeds a certain ground shake intensity) and a third party verifies them.

Make a Financial Plan

While earthquake insurance isn't realistic for the entire population, there are still actions you can take to prepare.

Visit Ready.gov to learn how to prepare your finances for disasters like earthquakes.

Earthquake Insurance Infographics

Download the Earthquake Insurance infographic for a poster of this webpage, plus bonus information about what your typical homeowner’s insurance does and does not cover.

Take control of your financial future and download the Earthquakes Can Drain Your Bank Account infographic.

Resources

This guide provides essential financial preparedness advice for renters in earthquake-prone areas. It covers the potential financial impacts of an earthquake. The guide outlines various financial tools renters can use for recovery, such as savings, insurance, loans, and disaster assistance, and emphasizes the importance of earthquake insurance and maintaining financial resilience before a disaster strikes.

This guide provides essential financial preparedness advice for homeowners in earthquake-prone areas. It covers the potential financial impacts of an earthquake. The guide outlines various financial tools homeowners can use for recovery, such as savings, insurance, loans, and disaster assistance, and emphasizes the importance of earthquake insurance and maintaining financial resilience before a disaster strikes