Process Overview

Eligibility

Funding Duration

Cost Share

Applying Through Grants.gov

Request Additional Weeks

Reporting Requirements

Required Forms & Attachments

Requesting Extensions to the Period of Performance or the Closeout and Liquidation Periods

Grant Closeout

Post-Closeout Requirements

Contact Us

Related Content

To ease the economic burden for those struggling with lost wages due to the coronavirus (COVID-19) pandemic, President Donald J. Trump authorized FEMA to expend up to $44 billion from the Disaster Relief Fund for lost wage payments.

FEMA provided grants to participating states, territories, and the District of Columbia (hereinafter “states”) to administer delivery of lost wages assistance for which they would have received an additional amount up to 5% of the total grant award to cover their administrative costs, subject to the cost share

The President's authorization for FEMA to use the Disaster Relief Fund (DRF) to supplement the payment of lost wages as a result of COVID-19 is in addition to the $8.8 billion FEMA previously obligated to date in the fight against COVID-19.

The President authorized the FEMA Administrator to provide grants to the states to make supplemental lost wages payments to those receiving unemployment insurance compensation, in accordance with section 408(e)(2) and (f) of the Stafford Act (42 U.S.C. §§§ 5174(e)(2), (f))

Process Overview

States, territories and the District of Columbia requested assistance by submitting an application for a grant award to administer the supplemental payments for lost wages.

FEMA provided states, territories and the District of Columbia with complete instructions, required forms and recommended templates to support the application process. The materials were posted on FEMA.gov and Grants.gov.

When making a request, the state, territory or District of Columbia government submitted the following to FEMA:

- Standard Form (SF) 424, Application for Federal Assistance

- SF-424A Budget Information for Non-Construction Programs

- Provide a weekly benefits and claimant projection for each category of benefits listed for eligible individuals

- SF-424B Assurances for Non-Construction Programs

- Grants.gov Lobbying Form

- SF-LLL Disclosure of Lobbying Activities

- FEMA Form 010-0-11: Individuals and Households Program - Other Needs Assistance Administrative Option Selection that includes the correct selections for an ONA Lost Wages Grant

- Indicate selection of $300 or $400 weekly supplemental lost wages payment to eligible individuals

- New State Administrative Plan

Upon approval, FEMA obligated funds to the state, territory or District of Columbia to administer the lost wages payments in conjunction with its respective unemployment office. Participating states, territories and the District of Columbia provided supplemental lost wages payments to eligible individuals retroactively, beginning with the week of unemployment ending August 1, 2020.

Funding Duration

Lost wages supplemental payments ended on December 27, 2020.

FEMA grant funding to each state was based on the state’s projected estimate of the amount of lost wages supplemental payments to be made per week, the estimate of eligible claimants, and a planning estimate for the state, inclusive of FEMA’s budgetary authority.

Eligibility

Participating states, territories and the District of Columbia provided supplemental lost wages payments from the week of unemployment ending August 1, 2020, to individuals (“claimants”) eligible for at least $100 per week in unemployment insurance compensation from any of the following:

- Unemployment compensation, including regular State Unemployment Compensation, Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Service members (UCX)

- Pandemic Emergency Unemployment Compensation (PEUC)

- Pandemic Unemployment Assistance (PUA)

- Extended Benefits (EB)

- Short-Time Compensation (STC)

- Trade Readjustment Allowance (TRA)

- Payments under the Self-Employment Assistance (SEA) program

Claimants were required to self-certify that they were unemployed or partially unemployed due to disruptions caused by the COVID-19 pandemic as part of the initial unemployment insurance claims process and or required weekly recertifications.

Cost Share

Participating states, territories and the District of Columbia had the option to provide claimants a lost wages supplement of up to $400, composed of a $300 federal contribution from the Disaster Relief Fund and an additional amount up to $100 from state funds.

States, territories and the District of Columbia were allowed to source the state-funded portion from the Coronavirus Aid Relief and Economic Security fund allocation. The total lost wages supplemental payment could not exceed $400

Participating states, territories and the District of Columbia had the option instead to provide claimants the lost wages supplement of $300 paid entirely from the $300 federal contribution and satisfy the match, with no additional state payout, by leveraging existing state funding used to pay regular state unemployment benefits. In this case, the state had to demonstrate at the aggregate level that the total of its state-funded unemployment benefits to claimants receiving the lost wages supplement were at least 25 percent of the total lost wages assistance benefits paid in conjunction with all of the unemployment programs listed above.

Lost wages payments were administered and delivered by states pursuant to grant agreements with FEMA, in conjunction with the state’s unemployment insurance system.

Since states administered the grants, if a claimant was denied a lost wages payment states used their existing policies and processes for adjudicating appeals from individuals denied unemployment insurance benefits. States were also responsible for recovering improper lost wages payment benefits from claimants. FEMA did not administer benefits directly to claimants.

Applying Through Grants.gov

States applied for this grant through the Grants Portal.

- Application forms and instructions were accessed from the portal homepage, by selecting “Applicants” then “Apply for Grants.”

- Entering funding opportunity ID DHS-20-ONA-050-00- 99, selecting “Download Package,” and then following the prompts to download the application package.

- The application package should have included all required forms. Applicants were advised to review the list of required forms and attachments and ensure all were included when submitting the application.

Grants.gov provided applicants 24/7 technical support via the toll-free number 1-800-518-4726 and email.

States with questions regarding the intersection of this grant with state unemployment benefit programs were advised to contact the Department of Labor.

Required Forms and Attachments

Applications must have included:

State Administrative Plan

Applicants needed to attach a signed State Administrative Plan to the application. The plan should have detailed the methods used to implement standard Unemployment Assistance, and the supplemental payments for lost wages, as applicable.

States were encouraged to use the recommended template.

FEMA Form 010-0-11

Applicants needed to attach a completed FEMA Form 010-0-11: Individuals and Households Program (IHP) - Other Needs Assistance Administrative Option Selection to your application.

The form should have included the correct selections for a grant to administer supplemental payments for lost wages.

Additional Week Request Process

States, territories or District of Columbia submitted the following Lost Wages Additional Week Request documentation to FEMA:

- Lost Wages Additional Week Request Template

- SF-424A (can be found on grants.gov)

States/territories were expected to have already received an initial grant award from FEMA before submitting a Lost Wages Additional Week Request.

States/territories submitted Lost Wages Additional Week Request documentation for one week at a time. No more than one week should have been submitted on each Lost Wages Additional Week Request template. FEMA processed these requests within 3 business days.

- FEMA reviewed requests at the end of each week of eligibility. For example, the earliest FEMA will review a request for a fourth week of additional payments is August 22nd. The earliest FEMA will review a request for a fifth week of additional payments is August 29th. The earliest FEMA will review a request for the sixth week of additional payments is September 5th.

The state/territory did not have to disburse all benefit payments and administrative costs provided in the initial obligation prior to submitting a Lost Wages Additional Week Request.

The Lost Wages Additional Week Request Template asked states/territories to identify any excess Lost Wages Assistance benefit payment funds the state/territory may have received from FEMA in previous obligations.

- A state/territory may have had excess funds if the estimated number of claimants used to calculate previous obligations was higher than the actual number of eligible claimants paid.

- If the state/territory had not yet identified excess funds this information did not need to be provided.

- Any excess funds from previous obligations offset the Lost Wages Additional Week Request.

If the state/territory paid out benefits to claimants prior to submitting a Lost Wages Additional Week Request, the state/territory had to provide the Lost Wages Weekly Report that included the total, weekly dollar amount of actual lost wages benefit payments made to eligible claimants, paid by program in order to receive additional funding (refer to the Lost Wages Weekly Report Template).

The SF-424A included with the Lost Wages Additional Week Request documentation should only have included one week’s worth of expenses.

Lost Wages Reporting Requirements

Weekly Reporting Requirement

States and territories that received a grant award for supplemental lost wages payments were required to provide FEMA a Lost Wages Benefits Payment Weekly Report that included the total, weekly dollar amount of actual lost wages benefit payments made to eligible claimants, by program, the number of appeals for the underlying benefits received by claimants, and any pending claims. The state/territory used the Lost Wages Weekly Report Template for the weekly submission.

- The template asked states/territories to provide the cumulative number of open appeals, and the number of new appeals for the one-week reporting period.

- The template asked states/territories to provide the cumulative number of open appeals, and the number of new appeals for the one-week reporting period.

- The template also asked states/territories to provide the cumulative number of pending LWA claims. Claims must have been filed or in process prior to the end of the period of assistance (December 27, 2020).

- The number of open and new appeals, as well as pending claims should have been reported as the total number of weeks represented by the appeals and claims and must be related to LWA and only for the weeks ending August 1, 2020 to September 5, 2020. As an example, if a pending claim for an individual would cover all six (6) weeks of funding, that should be counted as 6 claims.

The Lost Wages Weekly Report should have been provided to FEMA and are required until all claims were paid.

Quarterly Reporting Requirement

States/territories must submit the SF-425 form to FEMA on a quarterly basis throughout the grant award period of performance, including any partial quarters in which the period of performance is open. (To view the SF-425, Federal Financial Report file, right-click, save the file to your computer and open it in Adobe Reader or Acrobat). States/territories must submit the report even if no grant award activity occurs during a given quarter.

In the case of any potential or actual noncompliance, including delinquent reports, a demonstrated lack of progress, or an insufficient detail in the reports, FEMA may place special considerations on an award and/or FEMA may place a hold on funds until the matter is corrected or additional information is provided per 2 C.F.R. §§ 200.207 and 200.338.

The following reporting periods and due dates apply for the SF-425 Federal Financial Report:

| Reporting Period | Report Due Date |

|---|---|

| October 1 – December 31 | January 30 |

| January 1 – March 31 | April 30 |

| April 1 – June 30 | July 30 |

| July 1 – September 30 | October 30 |

The SF-425 Federal Financial Report should be provided to FEMA.

These additional instructions should assist in filling out the SF-425. Additional instructions and directions were provided within the SF-425 itself, and recipients were strongly encouraged to review those directions prior to filling out the form.

Requesting Extensions to the Period of Performance or the Closeout and Liquidation Periods

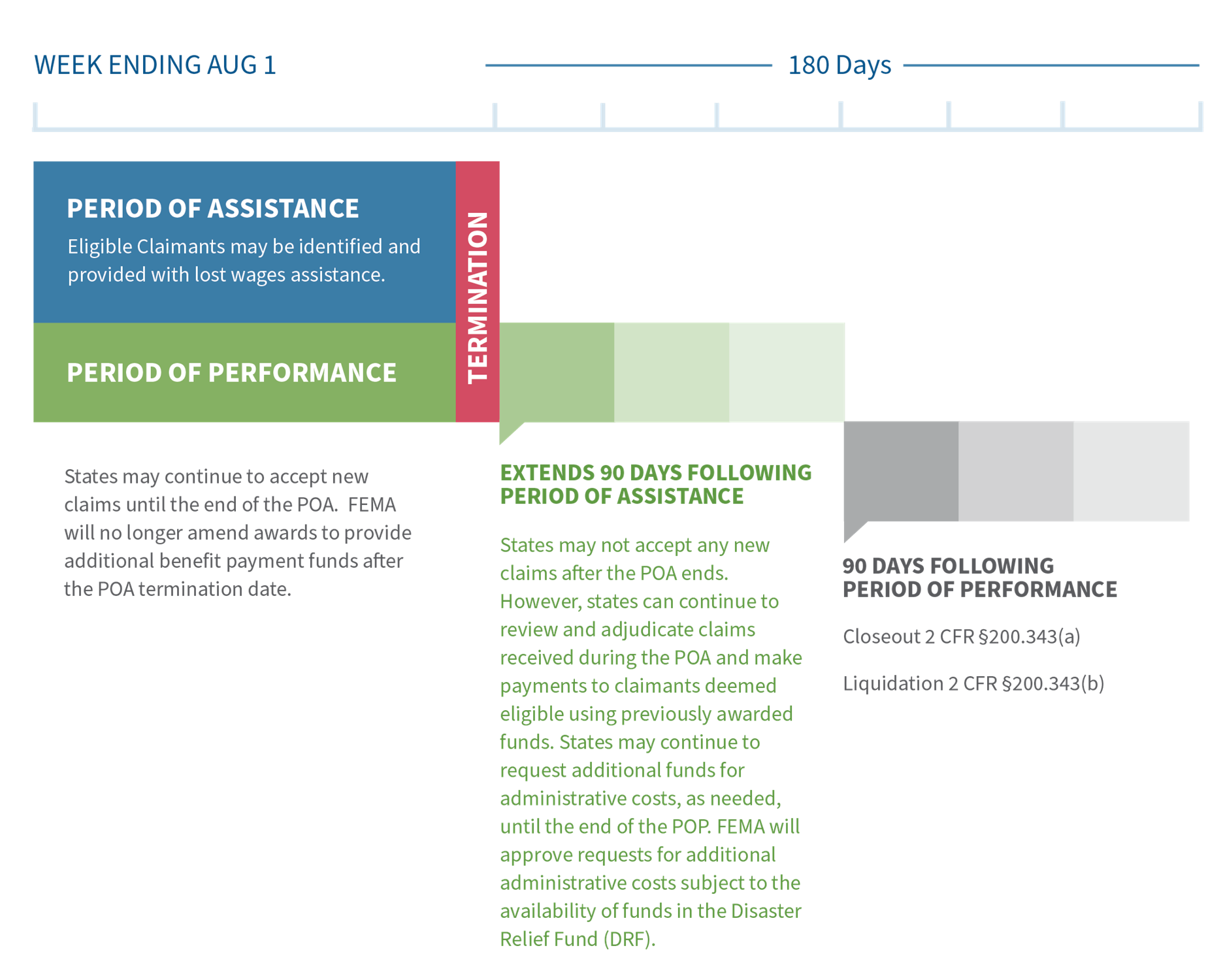

The LWA program Period of Performance extends 90 days beyond the Period of Assistance to allow states, territories, and the District of Columbia time to complete payments and investigate and recover improper payments. Following the end of the Period of Performance, states, territories, and the District of Columbia have 90 days to submit closeout reports and liquidate obligations. (See 2 C.F.R. § 200.343(a)-(b).) The closeout and liquidation periods conclude – unless extensions are granted – 90 days after the Period of Performance ends. The initial Period of Performance for all states, territories, and the District of Columbia ended on March 27, 2021; therefore, the initial closeout and liquidation period ended on June 27, 2021.

Upon request, the Period of Performance and the closeout and liquidation periods may be extended. (See id. (a)-(b).).

To request an extension to the Period of Performance, the state, territory, or the District of Columbia must provide a written request to FEMA providing justification for the extension to include any specific data necessary for the request and the timeframe for the extension request.

- Extensions can be requested for 1, 2, 3, 4, 5, or 6 months. No more than 6 months can be requested at a time. If necessary, states, territories, and the District of Columbia can request additional extensions; however, no more than 1 year, in total (to March 27, 2022), will be authorized.

- Specific data to justify a Period of Performance extension request could include the number of claims left to pay, number of appeals to be adjudicated, average processing time for appeals and pending claims, total anticipated timeframe to complete processing, etc.

- FEMA will automatically extend the closeout and liquidation periods to end 90 days after the new end date for an approved Period of Performance extension.

Period of Performance extension request letters should be sent to FEMA-LWA-Reporting@fema.dhs.gov no later than 15 days prior to the end of the Period of Performance. A standard template for requesting a Period of Performance extension is suggested.

To request a further extension to the closeout and liquidation periods (i.e., in addition to the automatically granted extension approved with a Period of Performance extension), the state, territory, or the District of Columbia must provide a written request to FEMA providing justification for the extension to include any specific data necessary for the request and the timeframe for the extension request.

- One extension can be requested for 1, 2, or 3 months. No more than 3 months will be authorized.

- Specific data for a closeout and liquidation period extension request could include the number of overpayments that continue to be collected, the status of final reconciliation of costs, etc.

Closeout and liquidation periods extension request letters should be sent to FEMA-LWA-Reporting@fema.dhs.gov no later than 15 days prior to the end of the closeout and liquidation periods. A standard template for requesting an extension to the closeout and liquidation periods is suggested.

Grant Closeout

States, territories, and the District of Columbia must submit their final closeout reports (2 C.F.R. § 200.343(a)) and liquidate all obligations under the Federal award (2 C.F.R. § 200.343(b)) by the end of the closeout and liquidation periods.

(Please note the Office of Management and Budget published revisions to 2 C.F.R. Part 200, the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards that were effective on November 12, 2020. However, 2 C.F.R. Part 200 as in effect on the date of the major disaster declaration authorizing LWA is applicable to LWA.)

- 2 C.F.R. § 200.343, states, territories, and the District of Columbia have a duty to reconcile costs and payments, resolve negative audit findings, and submit final reports to FEMA. (See also 44 C.F.R. § 206.120(f)(4).)

- States, territories, and the District of Columbia have an obligation to recover all improper payments, including assistance awards fraudulently obtained and awards made in error. (44 C.F.R. § 206.120(f)(5).) (See also 2 C.F.R. § 200.344 and LWA Overpayment Waiver Authority Fact Sheet.)

- States, territories, and the District of Columbia have an obligation to expeditiously report allegations of fraud, waste, and abuse to the DHS Office of Inspector General (OIG) and to investigate allegations of fraud, waste, and abuse independently if requested by DHS OIG or in conjunction with DHS OIG. (See State Administrative Plan, III. Financial and Grants Management, E. Recovery of Funds and 44 C.F.R. § 206.120 (d)(3)(ix, x).)

Prior to the end of the closeout and liquidation periods, states, territories, and the District of Columbia must submit the following:

- A letter to FEMA requesting closeout (no standard template necessary);

- The final SF-425 Federal Financial Report (FFR); and

- The final progress report detailing accomplishments and impacts, describing the overpayment waiver process, and including a breakdown of total claimants, total benefit paid, total number and amount of overpayments, and total number and amount of overpayments waived by week of assistance and program to which the LWA benefit was applied.

- An inventory which lists the items, dates, and costs of equipment purchased with grant funds for purposes of administering supplemental lost wages. (44 C.F.R. § 206.120(f)(4).)

Final reports and letters requesting closeout must be sent to FEMA-LWA-Reporting@fema.dhs.gov.

After award closeout reports have been reviewed and approved by FEMA, closeout notices will be completed and sent to states, territories, and the District of Columbia. The closed notice will indicate the ONA Lost Wages Assistance grant is closed, list any remaining funds that will be or were de-obligated, and address post-closeout requirements.

Overpayment Adjustments and Return of Funds to FEMA

States, territories, and the District of Columbia are responsible for recovering assistance awards obtained fraudulently, expended for unauthorized items or services, expended for items for which assistance is received from other means, and awards made in error. (See 44 C.F.R. § 206.120.(f)(5).)

Any provision of state, territory, or District of Columbia law authorizing waiver of recovery of improper payments, including those discharged in bankruptcy, does not overcome the state’s, territory’s, or District of Columbia’s responsibility to return the total sum of improperly expended funds to FEMA. Granting waivers pursuant to the criteria established under Section 262 of the Continued Assistance for Unemployed Workers Act of 2020 provides the only path for waiver of debt owed to FEMA by a state, territory, or the District of Columbia (FEMA has a statutory duty to pursue collection of debts. See 31 U.S.C. § 3711(a)(1); Lawrence v. Commodity Futures Trading Comm’n, 759 F.2d 767, 772 (9th Cir. 1985); 31 C.F.R. § 901.1(a); The Debt Collection Improvement Act of 1996, Pub. L. No. 104-34; 31 U.S.C. § 3711(a); EXEC. ORDER 13520, Reducing Improper Payments (Nov. 23, 2009). (See next section, Overpayment Waiver Authority.)

FEMA recognizes that states’, territories’, or the District of Columbia’s efforts to investigate and pursue the recovery of fraudulent and improper payments may extend beyond the end of the Period of Performance, the closeout and liquidation periods, or after the grant has closed. However, states, territories, and the District of Columbia are responsible for returning any federal funds that they have liquidated but remain unobligated by the recipient and for reimbursing FEMA for improper payments regardless of when they are identified, even if the Period of Performance has expired or the grant has closed.

- For LWA grants that have not been closed (FEMA has not yet sent the closed notice), funds should be returned to the state’s, territory’s, or District of Columbia’s Department of the Treasury respective ASAP account for benefit or administrative funding.

- Overpayments identified after the grant has been closed and not waived pursuant to Section 262 of the Continued Assistance for Unemployed Workers Act of 2020 should be returned to FEMA using one of the methods described at FEMA’s Payments page.

States, territories, and the District of Columbia must reimburse FEMA for the federal share of awards not recovered through quarterly financial adjustments within the 90-day closeout and liquidation periods of the grant award.

For reimbursements not received by FEMA within the 90-day closeout and liquidation periods, FEMA will initiate the debt collection process. Unpaid amounts due may result in administrative fees and interest and penalty charges in accordance with the Debt Collection Improvement Act. Debt collection procedures will be followed as outlined in 44 C.F.R. Part 11 and 31 C.F.R. Chapter IX, Federal Claims Collection Standards (Department of the Treasury – Department of Justice).

To discuss payment options prior to billing and for all questions after a bill has been issued, please contact FEMA-Finance-NFE@fema.dhs.gov..

Overpayment Waiver Authority

Section 262 of the Continued Assistance for Unemployed Workers Act of 2020 provides that states, territories, and the District of Columbia may waive overpayments under the Lost Wages Assistance (LWA) program when the individual is not at fault for the payment, and repayment would be contrary to good conscience. Such waivers only apply to LWA and apply to both the requirement for repayment by individuals (to the states, territories, and the District of Columbia) and states, territories, and District of Columbia (to FEMA).

FEMA is providing information for guidance purposes only to aid states in developing criteria to assess individual “fault” and “good conscience,” and is meant to complement established waiver processes where they exist.

Questions regarding the specifics on how to implement the waiver authority for LWA overpayments, to include the applicability of existing state, territory, or the District of Columbia waiver provisions, if any, should be directed to the Office of the Attorney General or equivalent of the state, territory, or District of Columbia.

The final progress report requires a description of the overpayment waiver process and a breakdown of total claimants, total benefit paid, total number and amount of overpayments, and total number and amount of overpayments waived by week of assistance and program to which the LWA benefit was applied.

Post-Closeout Requirements

Closure of a grant does not affect:

(1) FEMA’s right to disallow costs and recover funds on the basis of a later audit or review;

(2) The states’, territories’, and the District of Columbia’s obligation to return any funds due as a result of later refunds, corrections, or other transactions including final indirect cost rate adjustments; or

(3) The states’, territories’, and the District of Columbia’s obligation to expeditiously report allegations of fraud, waste, and abuse to the DHS Office of Inspector General (OIG) and to investigate allegations of fraud, waste, and abuse independently if requested by DHS OIG or in conjunction with DHS OIG.

States, territories, and the District of Columbia are required to maintain award records for at least three years from the date of the final FFR (SF-425). The record retention period may be longer than three years due to an audit, litigation, or other circumstances outlined in 2 C.F.R. § 200.333.

2 C.F.R. § 200.313 (equipment) requires maintenance of property records and these records must be maintained in accordance with 2 C.F.R. § 200.333 and be made available to FEMA and the DHS OIG upon request (2 C.F.R. § 200.336).

Contact Us

For additional information regarding Lost Wages Assistance, please contact FEMA-LWA-Reporting@fema.dhs.gov.

For additional information regarding return of funds to FEMA or billing, please contact FEMA-Finance-NFE@fema.dhs.gov..

Related Content

Lost Wages Assistance Approved States

FEMA Supplemental Lost Wages Payments Under Other Needs Assistance FAQ